ED IDR 2021-2024 free printable template

Show details

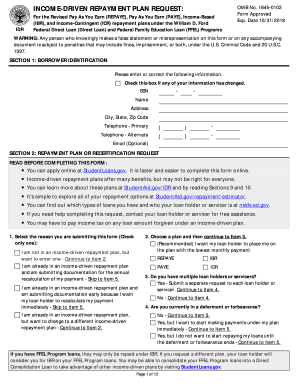

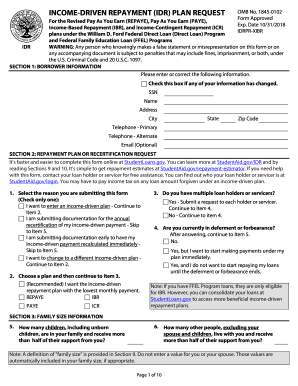

INCOMEDRIVEN REPAYMENT (IDR) PLAN REQUEST OMB No. 18450102

Form Approved

Expiration Date:

8/31/2021For the Revised Pay As You Earn (REPAY), Pay As You Earn (PAY),

Increased Repayment (IBR), and IncomeContingent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your income driven repayment 2021-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income driven repayment 2021-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income driven repayment online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income driven idr plan form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

ED IDR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out income driven repayment 2021-2024

How to fill out income driven repayment:

01

Gather all necessary financial documents including tax returns, pay stubs, and documentation of any additional sources of income.

02

Research and choose the right income driven repayment plan that suits your financial needs. Options include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

03

Visit the official student loan website or contact your loan servicer to access the income driven repayment application.

04

Complete the application accurately and provide all required information, including your Social Security number, contact information, and details about your income and family size.

05

Review the completed application to ensure all information is correct and sign it.

06

Submit the application either online or by mail, following the instructions provided.

07

Keep track of your application status by regularly checking online or contacting your loan servicer for updates.

08

Once your application is processed, you will receive information on your new monthly payment amount based on your income and loan size.

Who needs income driven repayment:

01

Individuals who have a high student loan debt compared to their income.

02

Borrowers with irregular or fluctuating income.

03

Those who are struggling to meet their current monthly loan payments.

04

Graduates who have recently entered the workforce and have a low starting salary.

05

Individuals in public service or non-profit careers, as they may qualify for loan forgiveness after a certain period of time under certain income driven repayment plans.

Fill idr form pdf : Try Risk Free

People Also Ask about income driven repayment

How long does it take to get IDR approval?

What is the best income driven repayment plan?

What are IDR documents?

Is pay as you earn better than IBR?

Is income-driven repayment good?

Is income based repayment better?

What is the downside of income-driven repayment?

How is IBR calculated?

Why am I not eligible for income based repayment?

What is the best income-driven repayment plan?

How to calculate student loan formula?

Which is an example of an income-driven repayment plan for student?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income driven repayment?

Income-Driven Repayment (IDR) is a type of student loan repayment plan that is based on the borrower's income and family size. These plans are offered by the US Department of Education and are designed to make repayment of student loans more affordable and manageable for borrowers with a limited income. IDR plans typically involve a lower monthly payment than a traditional repayment plan, but the total amount of interest paid over the life of the loan may be higher.

Who is required to file income driven repayment?

Anyone who has a federal student loan is eligible to apply for income-driven repayment plans. This includes borrowers with Direct Loans, FFEL Program loans, and Perkins Loans.

How to fill out income driven repayment?

1. Gather information about your income and family size: To fill out an income-driven repayment plan, you will need to know your adjusted gross income (AGI) and the size of your family. This information can be found on your federal tax return.

2. Choose an income-driven repayment plan: There are four types of income-driven repayment plans: Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has different requirements, so you should research each one to determine which one best fits your needs.

3. Fill out the application: You can apply for an income-driven repayment plan through your federal student loan servicer. Be sure to provide accurate and up-to-date information on the application.

4. Submit documentation: You may be asked to provide additional documentation to verify your income and family size, such as pay stubs, tax returns, or other documents.

5. Review and submit: Once you have reviewed the information on the application, you can submit it. You should receive a response from your loan servicer within a few weeks.

What is the purpose of income driven repayment?

The purpose of income-driven repayment (IDR) is to make federal student loan repayment more affordable for borrowers who have a low income relative to their loan debt. IDR plans adjust the monthly loan payment based on the borrower's income and family size. This ensures that borrowers do not face excessive financial burden and have a reasonable repayment amount that corresponds to their income level. IDR plans provide flexible terms, forgiveness options, and extended repayment periods, giving borrowers more manageable options for loan repayment. The ultimate goal is to prevent default on student loans and alleviate the financial stress of borrowers.

What information must be reported on income driven repayment?

When reporting income for an income-driven repayment plan, the following information must typically be provided:

1. Gross income: This includes any income earned from employment, including wages, salaries, bonuses, tips, commissions, and self-employment income.

2. Adjusted gross income (AGI): AGI is the total income earned minus certain adjustments, such as contributions to retirement accounts, self-employed health insurance deduction, moving expenses, and alimony paid.

3. Family size: This includes the number of people who are financially dependent on the borrower, including the borrower's spouse and children.

4. Federal tax filing status: This refers to the taxpayer's filing status, such as single, married filing jointly, married filing separately, or head of household.

5. Federal income tax paid: This includes the total amount of federal income tax paid during the tax year.

6. State and local taxes: The amount of state and local income tax paid during the tax year, if applicable.

7. Other deductions: Certain deductions like student loan interest paid, educator expenses, and qualified tuition and fees deduction may be considered when calculating income-driven repayment plans.

It is important to note that these requirements may vary depending on the specific income-driven repayment plan and the application process. Additionally, documentation such as tax returns or income verification documents may need to be provided as proof of income.

How can I modify income driven repayment without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including income driven idr plan form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit income driven repayment idr on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit income driven repayment form.

Can I edit income driven plan form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like idr form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your income driven repayment 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Driven Repayment Idr is not the form you're looking for?Search for another form here.

Keywords relevant to income driven repayment idr plan request form 2022 pdf

Related to repayment idr

If you believe that this page should be taken down, please follow our DMCA take down process

here

.